How much life insurance do I need?

This page will help you better understand general rules for determining the amount of life insurance you need.

Even if you’re a part-time worker or stay-at-home parent, you should consider having enough insurance to pay for things like:

- Childcare expenses

- Household duties

- Funeral costs

Basically, you need enough to cover all the extra costs your family would have in your absence, especially while your kids are still at home. And generally, the more dependents you have – and the younger they are – the more life insurance you may need.

General rules of thumb for determining how much life insurance you need

Here are a few simple ways to estimate your life insurance need.

-

1. Paycheck protection approachBased on the value of your future earnings, a simple way to estimate this is to take your monthly take home pay (after taxes and all deductions), multiply it by 12 to get your annual take home pay. Then take the annual take home pay and multiply it by the number of years until your retirement (which for most people should be age 65). For example, let’s say you’re 35 years old and your annual take home pay is $60,000. Your life insurance need if you were to pass away today would be $1,800,000 (calculated by taking $60,000 and multiplying it by 30).

-

2. Use the LIFE formula

This method considers future expenses in addition to future earnings. LIFE stands for Liabilities, Income, Final Expenses, and Education – four significant factors to consider when making a detailed estimate of your life insurance needs. [Calculate your unique needs with our online calculator.]

Liabilities: Total all your debts: mortgage, car loans, credit cards, student loans – even personal obligations such as money you may have borrowed from a sibling to put a down payment on your house.

Income: How much do you make a year? And how many years will your family need that money? It’s a tricky question to answer, but a good place to start is determining how many years until your youngest child graduates from college. For example, if you make $60,000 and have ten years until your youngest graduates from college, put down $600,000 for income replacement.

Final Expenses: How much do you expect your family to pay for funeral costs?

Education: Calculate anticipated college costs for each of your children. How much should you add for each child? College education costs vary between public versus private, and in-state versus out-of-state: a general rule of thumb is somewhere between $100,000 and $200,000 per child. If you take the average – and have two kids – that's an extra $300,000.

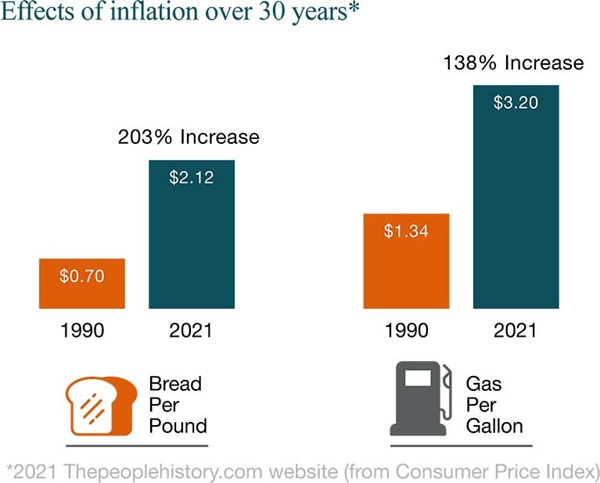

Add those four factors all up and that's your life insurance need amount. You can also adjust that number for any current savings and life insurance you already have and consider effects of inflation over time (see below for an infographic on effect of inflation for more details).

Effects of inflation over time

When you are calculating the amount of life insurance you might need, you should also factor in inflation. You may be calculating a life insurance need for today, but what happens 15 years down the road if you or someone in your family would die? The buying power of your life insurance policy proceeds could be worth half of what it would be today. That’s why it’s important to consider it for the policy you may purchase now.

So, how much life insurance do I need?

Ultimately, that answer has more to do with your feeling of being reassured that your family will be taken care of, even if you’re not around to provide that care. Remember, these are just general rules and you may have other assets, such as a small business or other obligations (such as caring for aging parents) you’re concerned with. That’s why it’s always best to take the time to talk to a financial professional who can provide the best recommendation. Just contact your agent who will take the time to learn your situation, listen to your concerns and explain the different life insurance options that best fit your needs.

Horace Mann Life Insurance Company underwrites Horace Mann life insurance products. The information provided here is for general informational purposes only, and should not be considered a recommendation or investment, tax or legal advice.